Be sure to meticulously sort through the fresh arrangement before you sign, spending extra attention so you can how attention adds up which is paid off. With a home loan, for instance, your bank cannot foreclose in your household even though the appraised really worth has gone down. Providing you always create your home loan repayments, you can keep the house and will waiting to offer before market rebounds. Actually, you’ll have slightly less of your budget in the bottom than just if you had bought the new stock outright since the you’re going to have to pay interest to the lent matter. All content on this site is actually for informational aim simply and you can cannot make-up financial advice.

How margin trade work

When truth be told there’s an elevated gross margin, it reflects you to definitely a firm is ace from the controlling its creation costs if you are bringing inside ample conversion. The risk of losing on the internet change from holds, possibilities, futures, currencies, international equities, and you will fixed-income is going to be generous. Broaden exchange tips that have brief promoting, options and you will futures contracts, or currency trading. It’ll cost you desire each day for the all the borrowing lengthened for you. The base price is decided at the Morgan Stanley’s discretion in regards to officially approved rates such as broker call loan price. Base prices is actually subjest to improve rather than earlier find, as well as to your a keen intraday base.

Best Margin Trading Agents

- It’s imperative to admit you to even though diversity you are going to mitigate risk, trading which have margin is able to magnify potential losses would be to the worth of those opportunities fall.

- Had she invested merely their $3,000 inside the bucks, her development would-have-been regarding the $step one,100000.

- A great margin label try a demand of a broker to help you an excellent investor you to definitely more money must be put into the new trader’s membership to keep up the current positions.

- You can use margin to speculate this money is going to do well up against another.

- You could love to exchange 3,000+ areas with CFDs for the Money.com, and cryptocurrencies, shares, commodities, indices and you may fx sets.

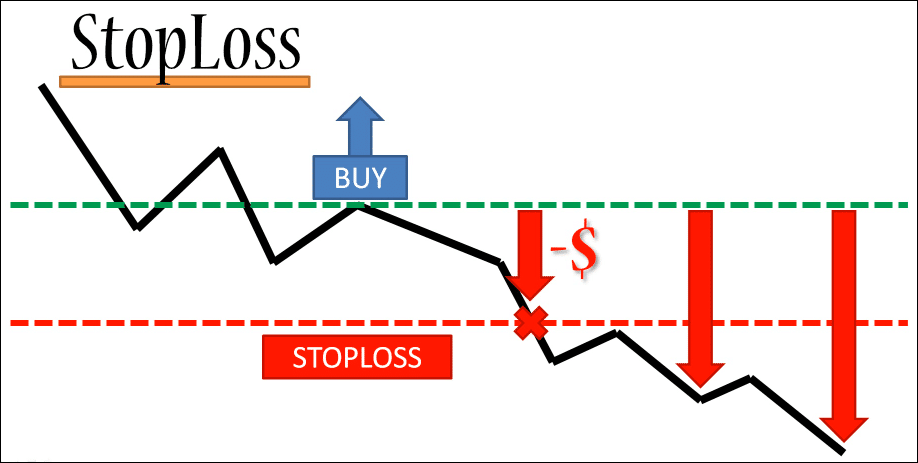

- Consider using prevent-limit purchases to minimize prospective losses in your investment.

Desire expenditures for the lent money you are going to escalate exchange can cost you and you will fade your overall growth or magnify losses. One of the most ample is the risk of magnified losses since the control can mean dropping more than your own initial financing is always to a trade disperse adversely. Margin exchange as well as runs into focus expenditures one, throughout the years, you’ll fade people payouts or worsen loss. Leverage and margin portray very important impression on the field of exchange, but really they often times suffer with misinterpretation.

Let’s state you open a good margin account and you may deposit $5,000 in the cash, such as. Their agent would allow one to get $10,100000 property value inventory from the membership, and so they do charge a fee an annual rate of interest for the margin mortgage. Once you discover an alternative brokerage account, you might be offered the chance to prefer an excellent margin membership. These broker membership lets you deposit cash and borrow a much bigger sum of money to buy opportunities. As a rule of flash, agents will not allow it to be people to buy penny carries or 1st personal offerings (IPOs) on the margin because of the go out-to-date threats a part of such holds.

An extended reputation reflects a presumption that the price of the newest asset goes right up, when you’re a primary https://bitwaveonline.com/en/ condition reflects the alternative. Since the margin status is discover, the new investor’s assets play the role of equity to the lent finance. That is crucial for people to know, as most brokerages set aside the ability to force the newest selling out of such possessions should your industry moves up against their position (a lot more than or lower than a particular threshold). Margin account offer leverage, enabling traders to take larger ranking than simply they may afford having fun with their own financing.

As well as the number that you may need as your full margin is actually always modifying since the value of your deals increases and you will falls. It is best to have at the least a hundred% of your own potential losses covered by your general margin. When you yourself have multiple ranks open as well, the new mutual overall of your needed margin per exchange are described as your own used margin. The bucks required to discover a trade is interchangeably regarded since the margin, very first margin, put margin or expected margin. Also, the newest individual is always to bundle to come to have eventualities such a good margin phone call.

At the Investment.com, i close-out the ranks to safeguard you against limitless losings, and include our selves of limitless accountability. Specific retail change systems, including Investment.com, offer promises one to in the event of the newest representative’s close-out failing woefully to limitation losses on your fix margin, they will dismiss any extra debt. You could trading cautiously, using restrict orders unlike industry requests, otherwise that have stop-losings requests positioned in order to control individual losses.

The relationship Anywhere between Harmony, Security, Margin and you can 100 percent free Margin

- The fresh calculation associated with the desire takes into account extent you use, the brand new appropriate yearly interest, and exactly how much time you keep the borrowed funds.

- Just before change, clients need to investigate related chance revelation statements to your all of our Warnings and you may Disclosures page.

- Treat this as your trade membership’s pillow, an instantaneous snapshot highlighting financing in hand to possess trade.

- Here’s what you must know before analysis the newest seas with margin trade.

- The top advantageous asset of to buy brings to the margin is the element to help you amplify the to purchase power and invite you to definitely pick a lot more than just you might in just the fund.

If the a market quickly moves up against your as you have a great exchange unlock, you can lose everything you provides on your margin account nevertheless are obligated to pay far more. You need to, but not, keep in mind that a stop-losses buy only will get triggered during the pre-set level, but is carried out in the next price height readily available. Including, should your marketplace is gapping, the fresh change gets eliminated away to your condition finalized in the a reduced favourable level than you to definitely pre-set. After you receive a good margin label, do not ignore it and you will do nothing. This might lead to a good margin closeout, in which the broker shuts their investments therefore risk losing everything you.

1st Margin

For more information investigate Features and Dangers of Standard Choices, also known as the choices revelation file (ODD). As an alternative, excite contact IB Customer care to receive a copy of one’s Weird. Ahead of trade, clients must check out the related chance revelation comments on the our Cautions and Disclosures page. Trading to the margin is only to possess educated investors with a high exposure endurance. For additional information regarding the prices to your margin money, please find Margin Mortgage Costs.

NerdWallet cannot and cannot guarantee the reliability otherwise applicability out of any information concerning your own personal things. Examples try hypothetical, and now we remind one seek individualized guidance away from qualified benefits out of specific money points. Our very own estimates are derived from prior market efficiency, and you may past overall performance isn’t a promise away from upcoming overall performance. Margin to purchase is one of the most important developments in the inventory exchange.

To search for the the new rate, the lending company contributes a good margin in order to a professional directory. Usually, the brand new margin remains an identical on the life of the loan, but the directory speed transform. Understand so it much more certainly, imagine a home loan with a varying rate who may have a margin out of cuatro% and that is listed to the Treasury Directory. If your Treasury Directory is actually six%, the speed to your financial is the six% directory price plus the cuatro% margin, otherwise ten%.